are salt taxes deductible in 2020

The Joint Committee on Taxation JCT estimated that the deduction for state and local taxes paid would cost the federal government 244 billion for 2020. Organizing an LLC for your business can convert non-deductible SALT into a business expense.

How To Deduct State And Local Taxes Above Salt Cap

November 13 2020.

. Notice 2020-75 applies to payments of. How Did The Tcja Change The Standard Deduction And Itemized Deductions Tax Policy Center The Joint Committee on Taxation JCT estimated that the deduction for state and local taxes paid would cost the federal government 244 billion for 2020. The SALT deduction is limited to 10000 per the Internal Revenue Tax Code for 2020 returns.

9 Notice 2020-75 agreeing that pass-through entity PTE businesses may claim entity-level deductions for state income tax paid under state laws that shift the tax burden from individual owners to the business entity. More recently in 2021 it was brought up again to increase the 10000 limit. If Congress does not make permanent the individual tax provisions the SALT deduction cap of 10000 per household will expire as scheduled after 2025.

A change in the tax laws effective for 2018 limits SALT and all other schedule A taxes deduction to 10000 so you have an excess of 10045 that is not showing on the same line as the 2020 amount greater than 10000. The limit is also important to know because the 2021 standard deduction is 12550 for single filers and 12950 in 2022. IR-2019-59 March 29 2019 The Internal Revenue Service today clarified the tax treatment of state and local tax refunds arising from any year in which the new limit on the state and local tax SALT deduction is in effect.

Those in lower tax brackets would benefit from lower savings through the SALT deduction while those in the highest tax bracket could save up to 3700 in federal income tax. State Local Tax SALT The IRSs clarification in 2020 that partnerships and S corporations may deduct their state and local tax SALT payments at the entity level in computing their nonseparately stated taxable income or. In the not-so-distant past taxpayers who itemized could generally write off the full amount of state and local tax SALT payments without any.

FYs 2019 and 2020 respectively. A taxpayer not subject to the alternative minimum taxand therefore able to take SALT deductionswho used to pay 100000 in state taxes could enjoy 100000 in federal tax deductions as a result. In proposed regulations released this week the Department of the Treasury and the Internal Revenue Service IRS have signaled their intention to bless one type of state workaround for the 10000 State and Local Tax SALT deduction cap.

The SALT deduction is limited to 10000 per the Internal Revenue Tax Code for 2020 returns. Spouses and the State and Local Tax Deduction Spouses Filing Separately. November 11 2020.

Real estate taxes also called property taxes for your main home vacation home or land are an allowable deduction if theyre based on the assessed value of the property and the property is for your own personal use. The net cost of state taxes was only 76000 as a result 100000 paid to the state minus 24000 in federal income tax savings. The IRSs 2020 clarification that partnerships and S corporations can deduct their business-level national and local tax SALT payments when calculating their separately unreported taxable.

Seventeen states have enacted SALT cap workaround laws and several others are working towards. This will leave some high-income filers with a higher tax bill. The IRS released guidance on Nov.

For New Jersey gross income tax purposes a married taxpayer filing separately is permitted to claim a deduction for up to 7500 of real estate taxes paid on their principal residence located. However that technique involving shifting the tax to a pass-through entity such as a partnership or S. The guidance clarifies uncertainty on the issue and supports partnerships and S.

9 2020 the Internal Revenue Service issued Notice 2020-75. Entity-level taxes that allow owners of pass-through business es to pay. As a result of this legislation the SALT deduction has been reduced.

For spouses that file separate tax returns the SALT deduction is limited to 5000 per person. 52 rows The SALT deduction is for itemizers who pay significant state and. So you need to have another 2550 of itemized deductions in 2021 and 2950 in 2022 beyond the SALT deduction in order to itemize.

Assuming this taxpayer also owns a home in New York property taxes will consume much of the 10000 federal cap so this SALT workaround will allow the taxpayer to deduct up to 10000 of state and local taxes paid in addition to a 12000 charitable contribution instead of being limited to a 10000 deduction for the total state and local taxes paid. 52132 less the excess taxes leaves you with 42087 in itemized deductions. During initial talks about tax reform the SALT deduction was almost eliminated.

For the first time the notice approves of one of the techniques that states have used to help taxpayers avoid the 10000 cap on the deduction of state and local taxes. The federal tax deduction for state and local tax SALT for taxpayers who itemize deductions was cut from unlimited to 10000 in 2018. As a result state and local income taxes whether mandatory or elective will be deductible at the level of the PTE and not passed through to individual partners or shareholders of the PTE who are subject to the state and local tax SALT deduction limitation that applies to individuals who itemize deductions for federal income tax purposes.

That excess of 10329 is showing for 2020. After legislators realized the impact of this it was decided to simply reduce the SALT deduction to 10000. You will report the 250 refund as income on your 2020 tax return.

What Are Itemized Deductions And Who Claims Them Tax Policy Center

How Did The Tcja Change The Standard Deduction And Itemized Deductions Tax Policy Center

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

3 Itemized Deduction Changes With Tax Reform H R Block

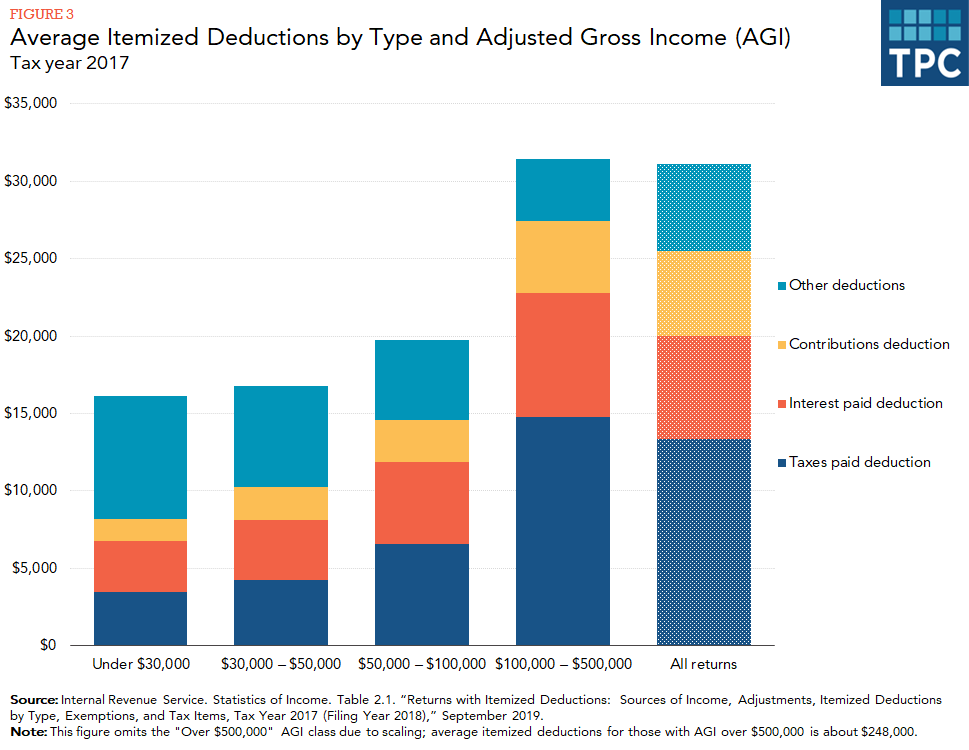

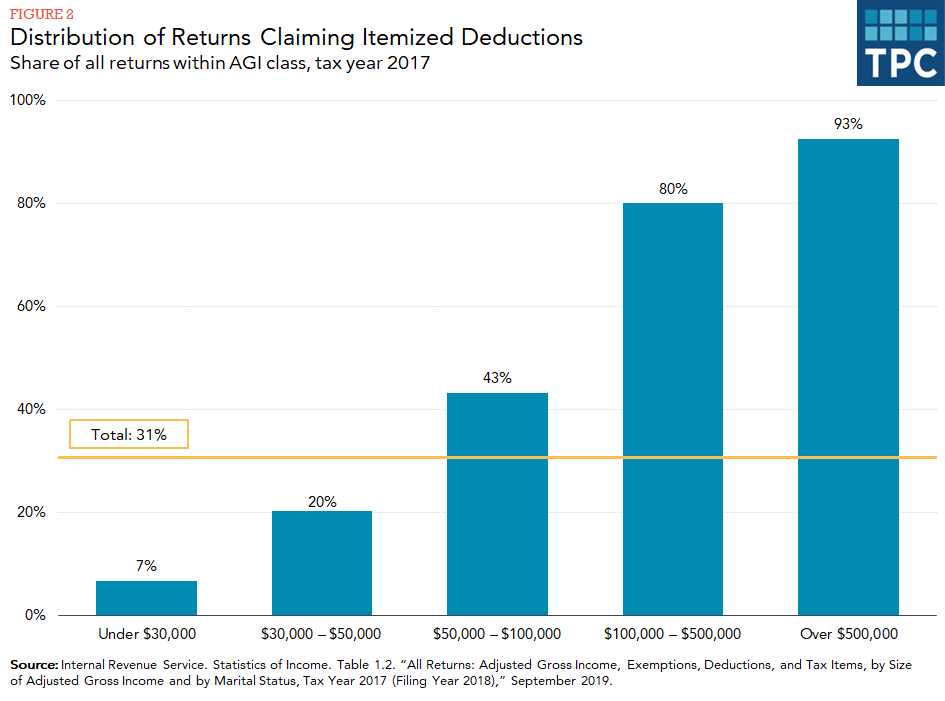

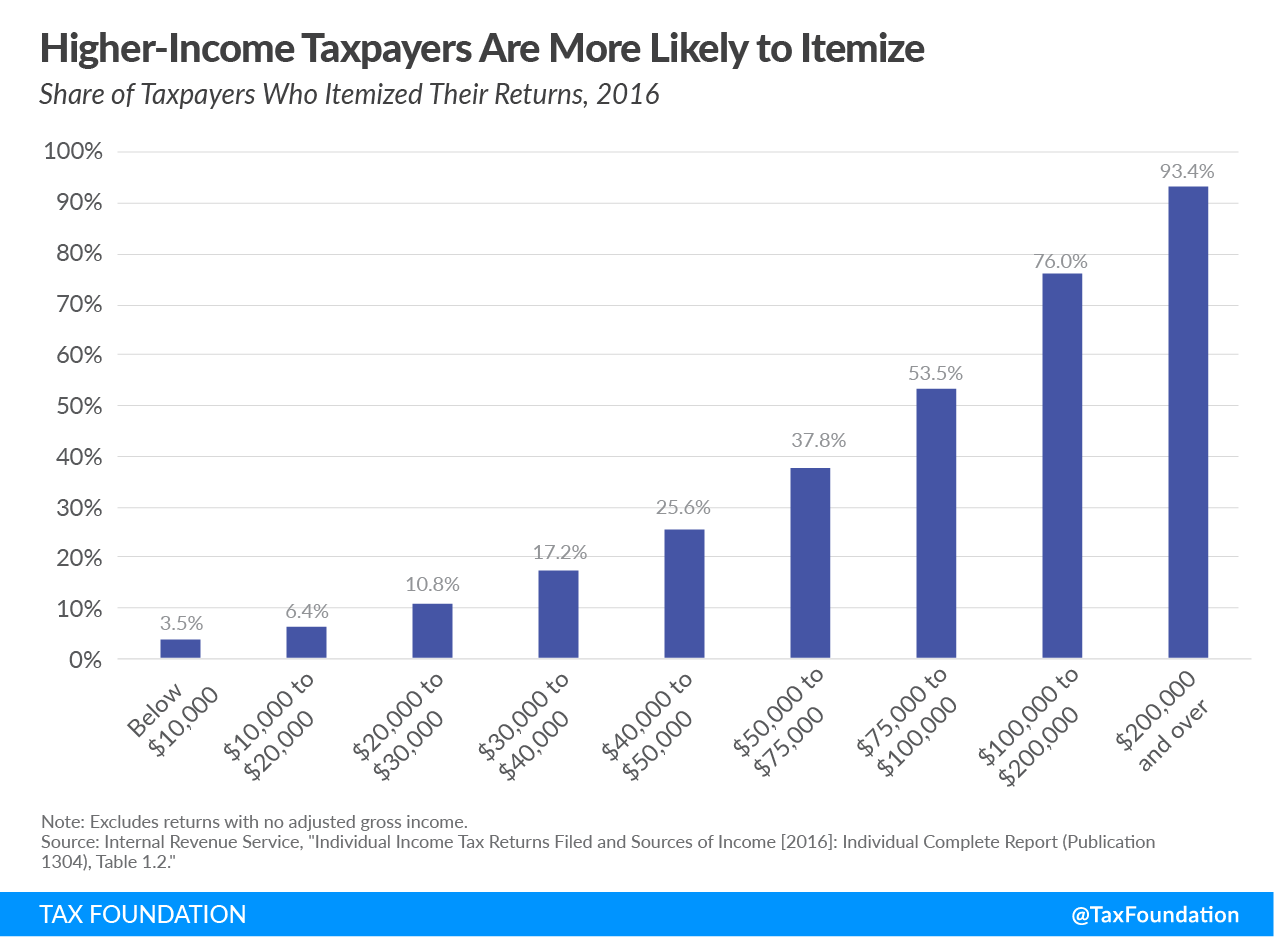

Itemized Deduction Who Benefits From Itemized Deductions

What Is The Salt Deduction H R Block

State And Local Tax Salt Deduction Salt Deduction Taxedu

Salt Deduction Work Arounds Receive Irs Blessing Look For More States To Enact Them Marks Paneth

New Limits On State And Local Tax Deductions Williams Keepers Llc

Tax Deduction Definition Taxedu Tax Foundation

Tax Credits Deductions For Your Transportation Business

Medical Expense Deduction Which Expenses Are Deductible Medical Financial Advice Tax Help

Standard Itemized Tax Deductions For The 2022 Tax Year Don T Mess With Taxes

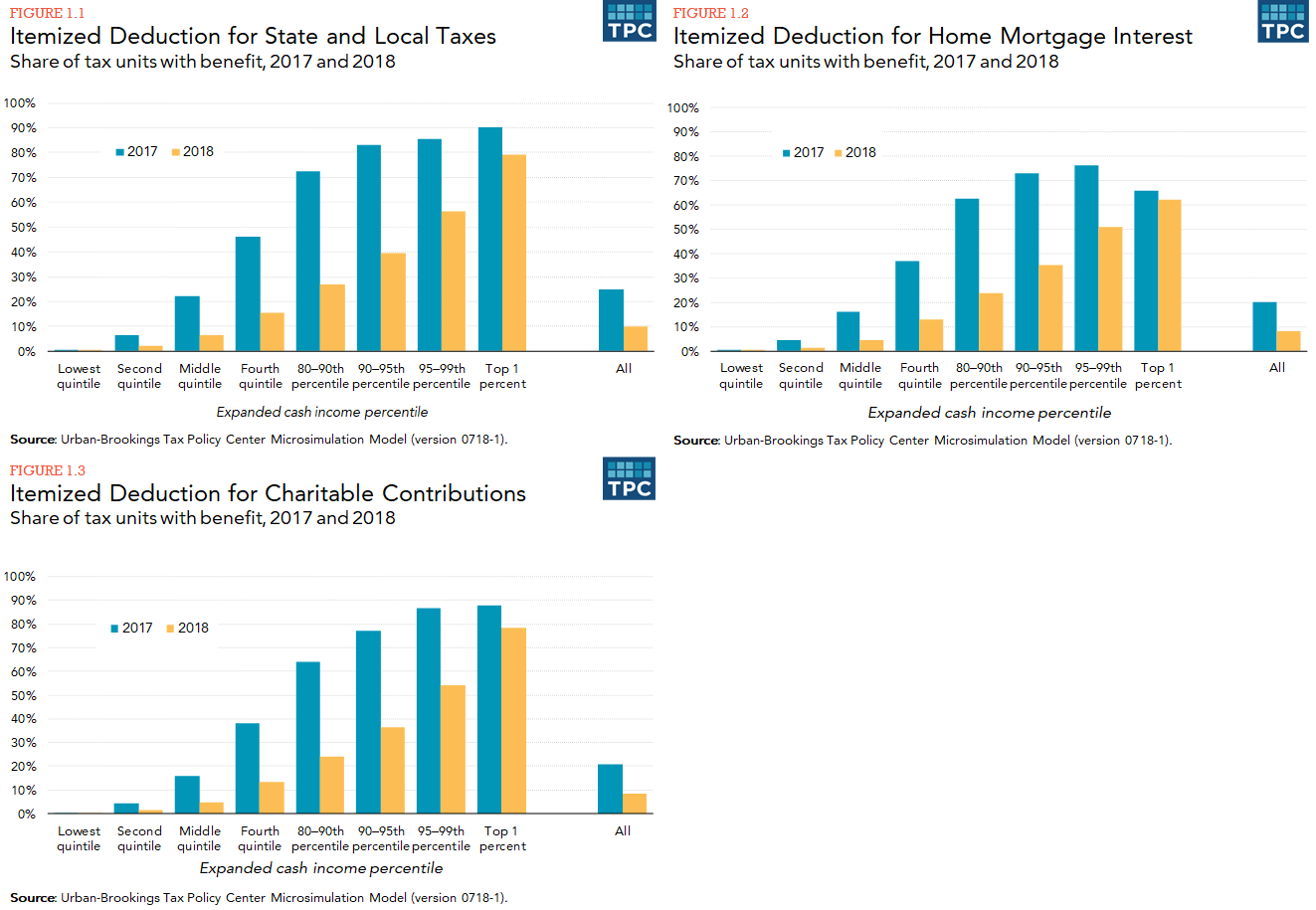

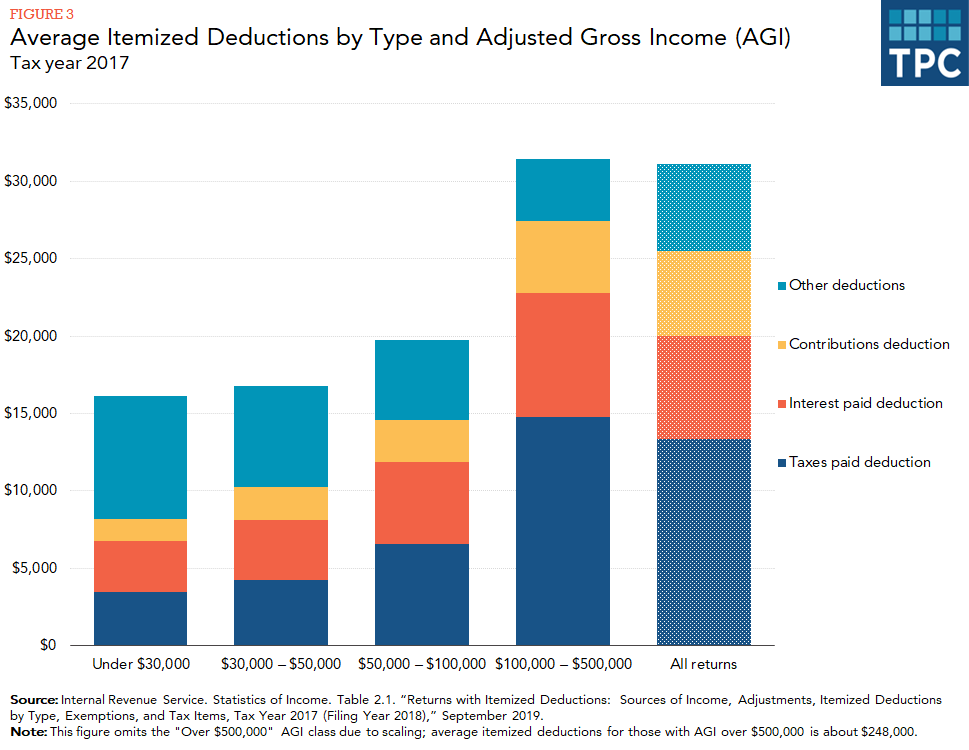

How Does The Deduction For State And Local Taxes Work Tax Policy Center

What Are Itemized Deductions And Who Claims Them Tax Policy Center

What Are Itemized Deductions And Who Claims Them Tax Policy Center

How Does The Deduction For State And Local Taxes Work Tax Policy Center

How Does The Deduction For State And Local Taxes Work Tax Policy Center

/trump-s-tax-plan-how-it-affects-you-4113968-6d78115126514c15a71278d826a751ed.gif)