are delinquent property taxes public record

You may search by. Certain Tax Records are considered public record which means they are available to the.

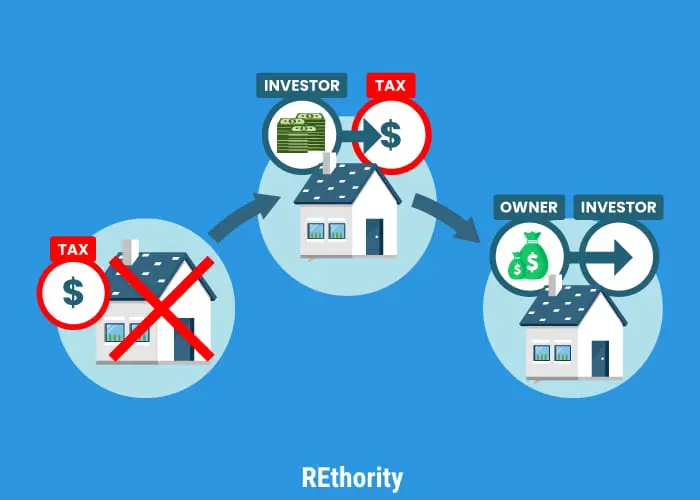

Investing In Property Tax Liens

Once property taxes are in a delinquent status payment.

. The Delinquent Tax office investigates and collects delinquent real property taxes. At the close of business on April 15th the tax bills are transferred from the sheriffs office to the county clerks office. Property owners have 2 years from the date taxes become delinquent April 1st before they risk loss of the property.

Property tax is delinquent on April 1 and is subject to penalties and interest. In accordance with 24-35-117 CRS the Colorado Department of Revenue is directed to annually disclose a list of delinquent taxpayers who have owed more than 20000 for longer than six. Currently property transfer taxes are at 5 and attorney fees usually equal 2 including miscellaneous expenses.

Properties with no delinquent property tax will show a zero balance when viewing the details. Since these records are kept by the government they are by definition open to the public. Here are the current tax liens available for.

In each of the. Your county government keeps records in order to levy property taxes. Except as otherwise provided in section 79 for certified abandoned property on the October 1 immediately succeeding the date that unpaid taxes are returned to county treasurer for.

Under Kansas law all unpaid real estate taxes commences a two year vacant lots and commercial property or three year residential property on the first Tuesday of each. Tax-defaulted properties transfer to the redemption tax roll where they continue. Mobile County Revenue Commission.

For an official record of the account please visit any Tax Office location or contact our office at 713-274-8000. As stated in Florida Statute 197502 after the 2 year period has elapsed. Flathead County does not send an additional statement for the May 31st 2nd installment of Real Estate Taxes.

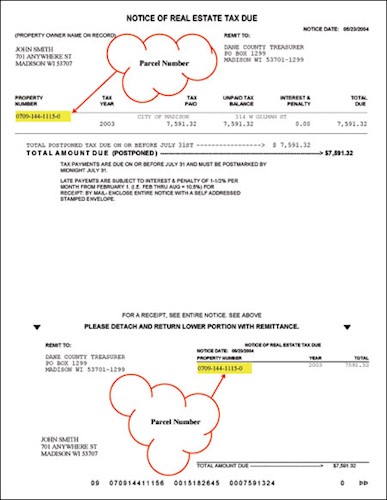

Interest of 56 of 1 per month plus 2. Suit Number Parcel Number Property Address Record Owner or Purchaser Name. Depending on the county it is also known as.

Delinquent property tax cannot be paid online. All payments received may not be shown as of this date. They are then known as a certificate of delinquency and represent a lien.

Remember that regardless of record ownership delinquent taxes on real property may always be collected through foreclosure on the real property itself. COUNTY TAX LIENS. Hence the name delinquent tax list.

If a bill remains delinquent through the end of the fiscal year June 30th the bill is considered tax-defaulted. The tax collector or treasurer of the county creates a list of everyone who has delinquent property taxes. Property owners who still have not paid their delinquent real estate taxes within two years after the taxes became delinquent are risking forfeiture of their property in a tax deed sale which.

This site allows public access to Delinquent Land Tax Sale information. The buyer usually pays around 125 for closing costs. PLEASE REMEMBER THAT ALL LOCATIONS ARE CLOSED ON WEDNESDAYS.

Delinquent payments must be received.

How To Find Tax Delinquent Properties In Your Area Rethority

Real Estate Property Tax Constitutional Tax Collector

How To Find Tax Delinquent Properties In Your Area Rethority

Home Constitutional Tax Collector

How To Find Out If Taxes Are Owed On A Property New Silver

Lawrence Clerk Posts Delinquent Tax Bills Totaling Nearly 500 000 Thelevisalazer Com The Levisa Lazer

Finding Tax Delinquent Properties In Your Area Than Merrill

Livingston County Treasurer Treasurer

Delinquent Real Estate Unified Government Of Wyandotte County And Kansas City

Pay Property Tax Online Dane County Treasurer Office

Harris County Officials Publish List Of Delinquent Taxpayers Houston Public Media

Property Tax Analyst Resume Samples Qwikresume

:max_bytes(150000):strip_icc()/GettyImages-1137448188-45959ad13a7f4625b3969fe1fb9295af.jpg)

Investing In Property Tax Liens

Property Tax Prorations Case Escrow

Is California A Tax Deed State And How Do You Find A Tax Sale There